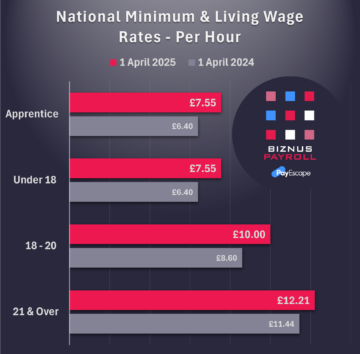

National Minimum Wage & National Living Wage Increases

Effective from 1st April 2025

See our blog for more in-depth information:

“By staying informed and proactive, businesses can smoothly

navigate these changes and continue

to thrive in 2025 and beyond.”

Effective from 6th April 2025

Changes to Employers National Insurance Contributions

In the new tax year 2025-26, the new Employer’s National Insurance threshold and percentage rate come into effect; this is also known as the Secondary Threshold (ST). Employer’s National Insurance is often described as “the tax on jobs” as it is a contribution that is paid on top of the gross pay for an employee.

For employers, two key changes are the most impactful to the cost of employing staff:

- Percentage contribution rate increases by 1.2% to 15%

- The secondary threshold to which the Employer’s NI becomes payable decreases from £9100 to £5000 per annum.

We have focussed on the main two NI changes that affect most employers. Other changes that occurred around national insurance for employers can be reviewed here:

https://www.gov.uk/guidance/rates-and-thresholds-for-employers-2025-to-2026

| Monthly Salary | Employers NI 2024-25 | Employers NI 2025-26 | Additional Cost Per Month | Additional Cost Per Year |

|---|---|---|---|---|

| £ 2000 | £ 171.40 | £ 237.50 | £ 66.10 | £ 793.20 |

| £ 3000 | £ 309.40 | £ 387.50 | £ 78.10 | £ 937.20 |

| £ 4000 | £ 447.40 | £ 537.50 | £ 90.10 | £ 1081.20 |

Employment Allowance

It’s not all bad news, there is some relief in the increase of the Employment Allowance from £5000 to £10500 per year.

In 2025-26 employers that could not before claim the allowance due to having over £100k in NI contributions will be able to claim the allowance.

It is important to understand that all other eligibility criteria remain unchanged, including the exemption for single director-only payrolls and connected companies.

Current eligibility rules: https://www.gov.uk/claim-employment-allowance/eligibility

Directors Pay

It’s quite common for a Company Director to be paid in a combination of a salary and dividends, in the past many chose to pay to the secondary threshold as this would also be enough to secure NI credits for state pension – this will no longer be the case in tax year 2025-26.

The table below will give you an indication of how National Insurance contributions will be applied to the level of pay.

| Monthly Salary | Employee NI Applies @ 8% | NI Credit Applies | Employer NI Applies @15% |

|---|---|---|---|

| Under £417 | No | No | No |

| £417 - £542 | No | No | Yes |

| £542 - £1048 | No | Yes | Yes |

| Over £1048 | Yes | Yes | Yes |

Each individual’s tax position can be affected by many factors including sources of other income, we recommend seeking advice from your accountant or tax adviser to discuss the best PAYE income for 2025-26.

The Personal Allowance for Income Tax remains frozen at £12570 per annum (£1048 per month), however depending on your tax coding set by HMRC your PAYE income may be taxed at a lower income level.