Starting 1 April 2025, the National Living Wage and National Minimum Wage rates in the UK will increase.

Starting 1 April 2025, the National Living Wage and National Minimum Wage rates in the UK will increase.

These changes affect workers across various age groups and roles.

Who Do These Rates Apply To?

- National Living Wage: Applies to workers aged 21 and over.

- National Minimum Wage: Applies to workers under 21 and apprentices.

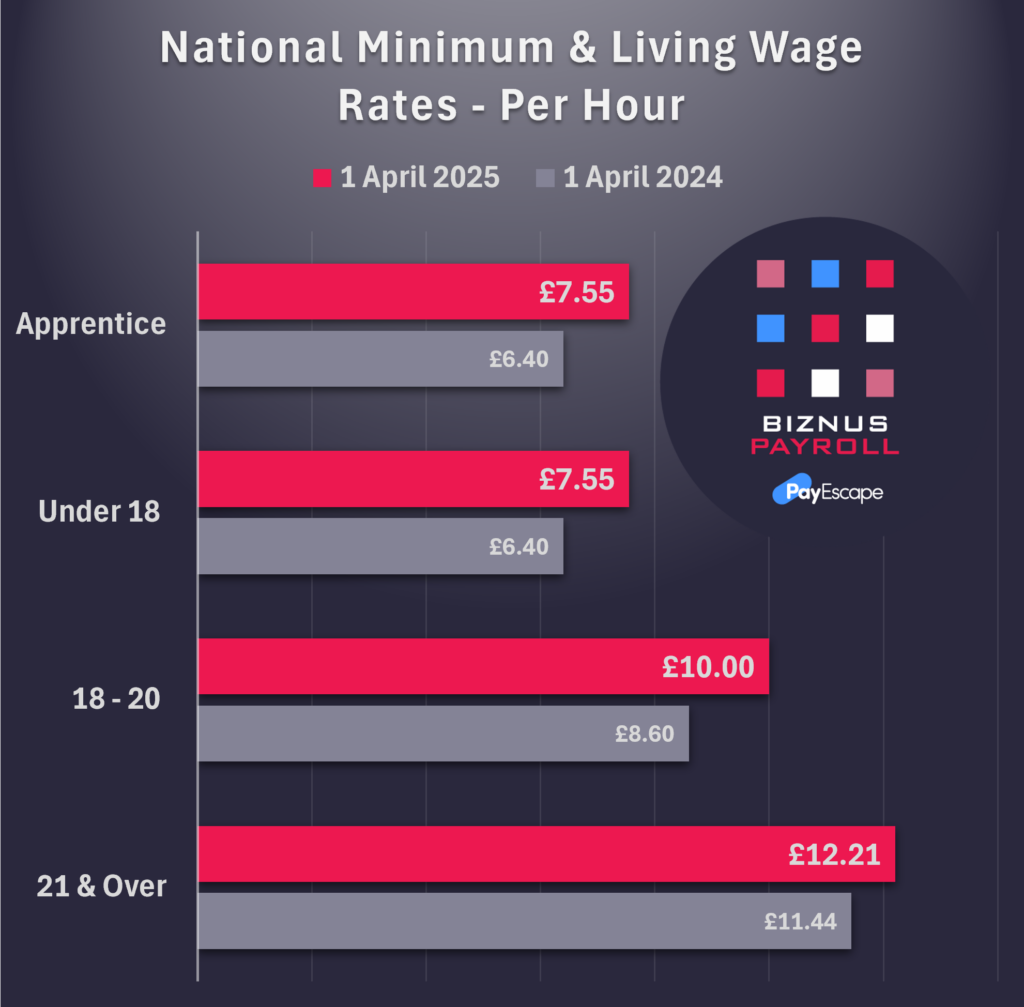

New Rates from April 2025:

- National Living Wage (21 and over): £12.21 per hour

- Ages 18 to 20: £10.00 per hour

- Under 18s: £7.55 per hour

- Apprentices: £7.55 per hour

These rates represent increases from the previous year. For instance, the National Living Wage will rise from £11.44 to £12.21 per hour, a 6.7% increase. The 18 to 20-year-old rate will see a 16.3% increase, from £8.60 to £10.00 per hour.

Comparison with Previous Year:

| Age/Category | April 2024 Rate | April 2025 Rate | Increase (%) |

|---|---|---|---|

| 21 and Over | £11.44 | £12.21 | 6.7% |

| 18 to 20 | £8.60 | £10.00 | 16.3% |

| Under 18 | £6.40 | £7.55 | 18.0% |

| Apprentice Rate | £6.40 | £7.55 | 18.0% |

Source: GOV.UK | Rates

Staying Compliant as an Employer:

To comply with these wage rates:

- Regularly review employee pay to meet or exceed the minimum rates.

- Keep accurate records of all payments to employees.

- Be aware of deductions that could reduce pay below the minimum wage, such as uniform costs or salary sacrifice arrangements.

Common mistakes:

- Not going back far enough on an employee’s earnings if you have underpaid them

- Not paying employees for overtime worked

- Deducting the cost of workwear or tools from an employee’s wages

- Not realising that a recent birthday of an employee can impact the rate they should now be paid

- Not paying employees while they are travelling for work

- Counting tips as part of an employee’s pay

A checklist of more common causes of minimum wage underpayments with links to relevant sections of GOV.UK guidance can be found here: GOV.UK | Checklist For Employers

Check whether any of the above common mistakes could apply to you. If you discover you have been paying your workers below the correct minimum wage, you must pay any arrears immediately, including any back pay.

For detailed guidance, visit the official government page on employer responsibilities regarding the minimum wage, here: GOV.UK | Employers

Consequences of Non-Compliance:

Failing to pay the correct minimum wage can lead to:

- Financial Penalties: Employers can be fined up to 200% of the underpaid amount per worker, with a maximum of £20,000 per worker.

- Public Naming: The government may publicly name employers who fail to pay the minimum wage, which can damage reputation.

- Legal Action: Employees can claim back pay through employment tribunals, and HMRC can take employers to court on behalf of workers.

It’s essential to stay informed and ensure your business complies with the latest wage regulations to avoid these consequences.